Market Review

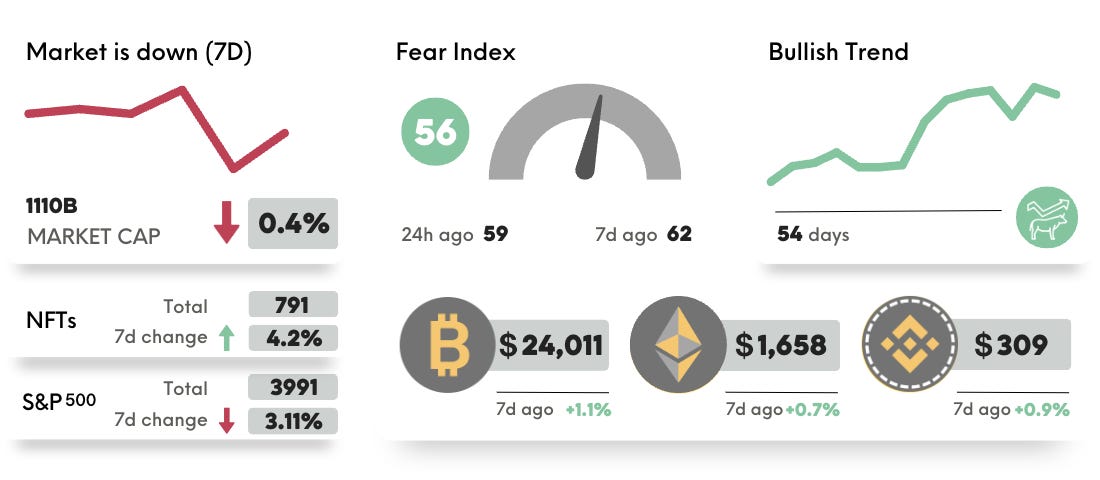

After many volatile weeks with a clear uptrend, this week was rather flat with some wild swings in a 2000$ range between 25.3k and 23.3k. We did see a relatively clear drop in equities, with the S&P500 losing more than 3% this week. Bitcoin is now around the 24k mark and Ethereum is hovering in the range between 1.6k and 1.7k.

It feels like no week passes without a new narrative in the altcoin market. This week the chatter was all about ‘Chinese' tokens or basically any token that could be used to create a narrative around the Asian market (either token is from Asia, team members are from Asia or the logo looks like a dragon. You choose…). This was mostly driven by the news that China seems to be loosening its stand on crypto (again). Especially tokens like Conflux, a Chinese-focused blockchain, spiked more than 200% this week.

Overall, the market seems to be in line with our expectations from last week, currently struggling with establishing clear support in the 24k area. For a bullish continuation, we would like to see BTC establishes an area around 24k as support and a few daily closes above the 25k level. Then a continuation towards the range between 28.5k and 30k seems very likely. On the downside, we would need to see the current range to hold (lows at 23.3k), otherwise, a move back toward 21k seems likely.

Our expectation remains that we will still test the previous lows in the next months, however, continue this current run towards 28k in the coming weeks. It's a great time to dollar-cost-average into the markets.

What else happened this week:

Coinbase is launching its own Ethereum Layer2 called Base. It will be built on Optimism - Optimism price increased by 20% afterward. It’s important to note that Coinbase will not launch a token (to avoid issues with the SEC), but if you are bullish on Coinbase, you can just buy the stock as well.

When to use a hardware wallet?

How to secure your Crypto tokens and why choose a hardware wallet?

There are many stories out there on Twitter and Reddit from people who lost all their Crypto savings due to ignoring one of the easiest rules in Crypto: Use a hardware wallet!

The stories are wild and sometimes heartbreaking. But it usually comes down to the following:

Forgetting to backup the Private Keys and losing access to their Wallet (e.g. Metamask)

Getting hacked or scammed and attackers can access digitally stored private keys (e.g. on Evernote or a Word document)

Having funds on a CEX (centralized exchange, e.g. Binance or Kraken) that goes bankrupt or stops withdrawals for users

There are many ways to be scammed in Crypto, but you avoid 95% when you hold your tokens in your own wallet and secure it with a hardware wallet.

How does it work?

Most important is to remember that cryptocurrencies are never stored within the hardware wallet (or any software wallet for that matter) itself, they always live on the blockchain. The wallet merely stores your private key. That private key opens the lock to your address on the blockchain where your assets actually are stored. Since the blockchain is everywhere, all you need is your wallet to interact with your tokens.

Hardware wallets have two main benefits over software wallets:

They protect your private keys. So even when the hardware wallet is plugged into your computer, hackers can not access the private keys

They let you confirm all transactions. Nobody that doesn’t physically hold your hardware wallet can make any transactions as you have to confirm all transactions on the hardware wallet

Your private keys stored on the hardware wallet are protected by a pin. You need your pin to log in, so should a thief take possession of your hardware wallet, it’s nearly impossible for them to extract your keys.

If your hardware wallet is lost, the assets are backed up with a single seed phrase. A seed phrase, also known as a recovery phrase, is a list of words that re-generate your private key. You can use your seed phrase to move your keys to a different hardware wallet. Make always sure to store this 24-word seed phrase in a secure location (a safe, inside a book, or your Mom’s underwear drawer).

When to use it?

From our point of view, it always makes sense to use hardware wallets. They add extra security with the only downside of added costs when purchasing the hardware wallet and complexity when making transactions. The only reasons not to use them are:

You only hold a small amount of Crypto which does not justify purchasing a hardware wallet (which costs about 80$).

You transact with the blockchain a lot (power user) and need to act fast for e.g. a rare NFT sale where the extra 5 seconds you need to confirm a transaction on a hardware wallet costs you valuable time

What Crypto Companies to Trust with Your Investments?

There are multiple companies out there with Ledger and Trezor by far the most known and most trustworthy (due to the time they are in the business). We recently saw a few other companies launching their hardware wallets as well, which could bring some more innovation to the space.

What would we recommend?

The best way to get started would be with a new Ledger Nano S Plus. It’s the newest hardware wallet from Ledger (the most trusted brand in the space) and is rather cheap at 80$. We recommend always buying directly at Ledger or with a trusted reseller so that you will only receive genuine devices and not buy used devices – they might have been tampered with.

Action for this week

In this section, we will summarise the main actionable items from each newsletter and other posts that are worth reading

Assess whether you need a hardware wallet (do you own more than 400$ in Crypto and don’t interact with the blockchain every 2 minutes?)

Go to ledger.com and pick your hardware wallet. We recommend the Ledger Nano Plus

Set it up and secure your seed phrase

Follow us on Twitter | Telegram ✅